Thursday, May 26, 2011

Wednesday, May 25, 2011

Video Upload

Here is an upload of the early market action, hopefully you'll find them beneficial to your trading.

Mark

http://www.youtube.com/watch?v=7VuROHWP3tU

Mark

http://www.youtube.com/watch?v=7VuROHWP3tU

ES Futures Update

With the nice rally off the low and the volitile after hours action yesterday we've made some headway but we are now up against the long term border of the trend channel It would take a convincing break to the upside to keep a bullish bias.

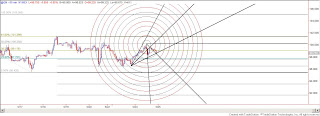

DOW Futures 05252011

Dow is flirting with the 1:1 (unison) extention.. tighten up stops.. 264 tick chart attached.

--Tony

--Tony

Tuesday, May 24, 2011

ES Update

With a near perfect 1:1 hit on the ES's in yesterdays action we are cautiously bullish this morning. If the 1310.75 level holds then this could be a decent swing trade setup. Exercise caution since picking tops and bottoms is tricky and the best trades to take are those in an established trend.

With a near perfect 1:1 hit on the ES's in yesterdays action we are cautiously bullish this morning. If the 1310.75 level holds then this could be a decent swing trade setup. Exercise caution since picking tops and bottoms is tricky and the best trades to take are those in an established trend. Mark

Monday, May 23, 2011

ES Future Update

From our report we placed a great deal of importance on the trend channel we where approaching. We stated that we're so close that its almost implausible that it won't be tested. The Futures are sitting on them right now and the cash index could reach it on the open. A break of this channel will lead to lower prices. Typical action would be that the market may bottom and rally back up to touch the channel before reversing. That is typically a low risk short in this case. God speed to all!

Mark

Mark

Sunday, May 22, 2011

Video Upload

Here is a link to the present video upload to youtube.com. We hope this helps enable you to take profitable trades. :)

Mark

http://www.youtube.com/watch?v=aJDdp5AjByc

Mark

http://www.youtube.com/watch?v=aJDdp5AjByc

Subscribe to:

Comments (Atom)